Activity

-

NAFA Administrator posted an articleUS Aviation Tax Planning for Aircraft Buyers in 2025 see more

Aviation tax planning in 2025 holds new promise for aircraft buyers, as shifting political landscapes and potential tax reforms from the incoming Trump Administration create a dynamic environment. After a year of heightened scrutiny from the IRS under the Biden Administration, buyers are hopeful that the new government will ease tax regulations and provide more favorable depreciation opportunities. With the possibility of 100% bonus depreciation returning, aircraft owners have reason to be optimistic about their tax planning in the near future. As the year unfolds, aviation tax planning will be crucial for making informed decisions in an uncertain regulatory landscape.

Aircraft buyers based in the US who plan to use their new and used planes primarily for business purposes have entered 2025 with reasons for hope that the year might prove favorable in terms of the tax treatment the US Federal Government affords their newly acquired aviation assets.

That hope is new, and it follows a year in which the tax picture at both US federal and state level for aircraft buyers began to show early signs of darkening.

In 2024, under what proved to be the outgoing Biden Administration, the US Internal Revenue Service (IRS) pronounced that it would direct greater scrutiny toward finding out to what extent owners were using their aircraft for business purposes – as legislation conferring tax benefits on purchases of aviation assets meant them to do.

The IRS further indicated it would put that scrutiny into practical effect by conducting increased numbers of tax audits on owners of new and used business and private aircraft.

That planned intensification of IRS focus would mean those owners who couldn’t document clearly that at least 50% of the flying they conducted with their aircraft during the year would be ineligible for the bonus depreciation schedule available, under the 2017 Tax Cuts and Jobs Act.

As matters stand today, the act’s provisions for bonus depreciation on aircraft and various other purchased assets are scheduled to end in 2027.

But the dawning of 2025 – and with it the assumption of power by the Trump Administration – has brought what is widely expected to be a dramatic sea change in the US Government’s regulatory ethos as it affects many areas of business. That sea change is expected to include a relaxation of tax legislation, and perhaps a contraction in the size and oversight power of the IRS.

As of this early-February writing, it remains to be seen to what extent the Trump Administration will honor the political promises the incoming Administration made during last year’s Presidential campaigning process.

Original CFS Jets' article published on AvBuyer on March 5, 2025.

-

NAFA Administrator posted an articleUS Aviation Tax Planning for Aircraft Buyers in 2025 see more

What can buyers of business and private aircraft in the USA hope for in 2025 in terms of potential tax benefits from their purchases? Experts share their insights with Chris Kjelgaard.

Aircraft buyers based in the US who plan to use their new and used planes primarily for business purposes have entered 2025 with reasons for hope that the year might prove favorable in terms of the tax treatment the US Federal Government affords their newly acquired aviation assets.

That hope is new, and it follows a year in which the tax picture at both US federal and state level for aircraft buyers began to show early signs of darkening.

In 2024, under what proved to be the outgoing Biden Administration, the US Internal Revenue Service (IRS) pronounced that it would direct greater scrutiny toward finding out to what extent owners were using their aircraft for business purposes – as legislation conferring tax benefits on purchases of aviation assets meant them to do.

The IRS further indicated it would put that scrutiny into practical effect by conducting increased numbers of tax audits on owners of new and used business and private aircraft.

That planned intensification of IRS focus would mean those owners who couldn’t document clearly that at least 50% of the flying they conducted with their aircraft during the year would be ineligible for the bonus depreciation schedule available, under the 2017 Tax Cuts and Jobs Act.

As matters stand today, the act’s provisions for bonus depreciation on aircraft and various other purchased assets are scheduled to end in 2027.

But the dawning of 2025 – and with it the assumption of power by the Trump Administration – has brought what is widely expected to be a dramatic sea change in the US Government’s regulatory ethos as it affects many areas of business. That sea change is expected to include a relaxation of tax legislation, and perhaps a contraction in the size and oversight power of the IRS.

As of this early-February writing, it remains to be seen to what extent the Trump Administration will honor the political promises the incoming Administration made during last year’s Presidential campaigning process.

This article was originally published by AvBuyer on March 5, 2025.

-

NAFA Administrator posted an articlePlanning a Jet Delivery? US Sales & Use Tax Tips see more

Every US state has its own combination of sales and use taxes, property taxes, and sometimes other surcharges it assesses on business aircraft based in, or even just flying to, the state. So how do you know where to arrange delivery of an aircraft to make best use of these? AvBuyer's Chris Kjelgaard asks the experts...

In addition to accounting for sales and use taxes on business aircraft, some states have generous exemptions too, so it’s fair to say that a tax consultant should always be one of the first team members hired by business aircraft buyers in the US to ensure the purchase is handled professionally, smoothly, and concludes successfully.

The most important thing is to call [the tax advisor] first, so you don’t make bad decisions, Daniel Cheung, Principal of aviation accountancy firm Aviation Tax Consultants highlights. “Make your tax planning proactively – call in a tax consultant in advance,” before the aircraft transaction gets under way.

Another reason why a tax consultant should be a core member of any US-based business aircraft acquisition team is that “the [US] tax code is not friendly in terms of complexity,” adds Cheung. “You have to deal with the IRS, the FAA, and even the Securities and Exchange Commission if you’re a public company.”

Cheung explains “proper planning obviously is the key” for any owner buying a business aircraft to minimize their tax exposure to the purchase. Assessments of sales and use taxes depend on where the aircraft is based or hangared, “particularly if the aircraft lives in two or three places”, in which case it may be subject to sales and use taxes in more than one state.

For instance, he notes, “Chicago, Illinois is extremely difficult in terms of tax, but Gary, Indiana [just over the Illinois-Indiana state border a few miles south of Chicago] is not.”

According to Cheung, “80% of the tax planning is based on IRS requirements”. These requirements should be a more immediate concern for the buyer’s purchase advisory team than compliance with FAA regulations, he says, because compliance is ongoing but the tax payment is one-time.

“So the primary discussion is focused on income tax requirements and ownership structure, because the key to the planning is ownership structure”, says Cheung.

“Who owns the aircraft is the key in terms of getting the bonus depreciation rights” which can be offset against tax liability, and “the corporate structure of the client will determine the structure of the ownership of the aircraft”.

This article was originally published by AvBuyer on May 8, 2024.

-

NAFA Administrator posted an articleNAFA Welcomes New Member: Stubbs Aviation Advisors see more

FOR IMMEDIATE RELEASE: February 28, 2024

Contact: Tracey Cheek

tlc@nafa.aero

405-285-7005

Nel Stubbs

nel@stubbsaviationadvisors.com

602.791.3824

NAFA Welcomes New Member: Stubbs Aviation Advisors

National Aircraft Finance Association (NAFA) is pleased to announce that Stubbs Aviation Advisors has recently joined its network of aviation professionals. Stubbs Aviation Advisors builds on the unmatched experience of Nel Stubbs, a preeminent aviation tax planning and compliance authority. It offers existing and potential aircraft owners and flight departments expert advice on federal, state and local taxes and aviation operating structures.

“NAFA members proudly finance, support or enable the financing of general and business aviation aircraft throughout the world, and we are happy to add Stubbs Aviation Advisors to our association,” said Ed Medici, President of NAFA.

About Stubbs Aviation Advisors:

Nel Stubbs, a leading expert on aviation taxes, recently launched Stubbs Aviation Advisors, a new consulting and advisory business to help aircraft owners and flight departments navigate aviation taxes and corporate aviation business structures.The business is backed by Stubbs’ four decades of experience and is part of the George J. Priester Aviation family of companies, though it operates independently. George J. Priester Aviation, led by Chairman and CEO Andy Priester, recognized the need to support the private aviation industry, as all aircraft owners can benefit from Stubbs’ unique skillset and experience.

In addition to federal, state and local tax advice, Stubbs Aviation Advisors offers aviation operating structure advice to satisfy Federal Aviation Administration, Department of Transportation and IRS regulatory obligations. It consults on short- and long-term aircraft and flight department operating costs and provides aircraft appraisals throughout the U.S.

To learn more, please contact Priester Marketing at 847-537-1133 or visit www.priesterav.com.

About NAFA:

The National Aircraft Finance Association (NAFA) is a professional association that has been promoting the general welfare of aircraft finance for 50 years. Our network of members is comprised of lenders and product service providers who work together to finance general and business aviation aircraft. NAFA sets the standard for best practices in aviation finance by educating its members on the most up-to-date industry trends and best practices. Government legislation, market influences and industry insights allow member companies to provide the highest quality services the industry has to offer. -

NAFA Administrator posted an article100% Bonus Depreciation Extension is Essential Piece of New 2024 Tax Deal see more

On Tuesday, January 16th, 2024 top lawmakers on the Senate and House tax writing committees announced a deal on a wide range of tax issues, including several business deductions facing possible phase down or sunset. Significant to the business aviation industry, the Act specifically extends 100% bonus depreciation.

The legislation, dubbed the Tax Relief for American Families and Workers Act of 2024, extends 100% bonus depreciation for eligible qualified property for qualified property placed in service after December 31, 2022, and before January 1, 2026 (January 1, 2027, for longer production period property and certain aircraft [1].) This change may directly impact 2023 filings, removing the 20% phase-down in the current law [2].

Taking bonus depreciation for a general aviation aircraft requires that the aircraft be used predominately in furtherance of the business activity, be placed in service in the tax year at issue, and that appropriate listed property books and records be maintained. Business form and type, ownership structure, and the nature of the business use may all impact bonus eligibility [3].

While passage remains uncertain, prominent Party leaders from both parties have publicly endorsed the agreement. They face a tight deadline to implement any changes to the tax code with the 2023 tax filing season beginning on Jan. 29.

This article was originally published by NAFA member, Suzanne Meiners-Levy, Partner, at Advocate Consulting Legal Group, PLLC, on January 18, 2024.

-

NAFA Administrator posted an articleExamining the Impact of Canada’s Select Luxury Items Tax Act on the Aviation Industry see more

In September 2022, the Canadian government passed the Select Luxury Items Tax Act, which imposes a 10% tax on aircraft valued at $100,000 or more. This tax can potentially impact the large Canadian business aviation industry, including OEMs, buyers, sellers, lenders, dealers and the supply chain of the business aviation industry.

Luxury taxes are controversial because they directly affect an individual’s purchasing power. As the Canadian government aims to increase its tax base, this article will discuss how the new luxury tax impacts those involved in aircraft transactions and the aviation business industry.

What is the Select Luxury Items Tax Act?

The Canadian government passed the Select Luxury Items Tax Act, which levies a 10% tax on selling and importing aircraft worth more than $100,000. The new tax went into effect on September 1, 2022. The Act also applies to luxury cars over $100,000 and boats over $250,000.

The legislation applies to “subject aircraft,” meaning an airplane, glider or helicopter. The aircraft must be manufactured after 2018. There are a few exemptions, including:

-

aircraft designed and equipped for military activities

-

aircraft equipped for the carriage of goods only

-

aircraft registered with a government before September 2022, provided that a user of the aircraft has possession before this date

The luxury tax also does not apply to the sale of a subject aircraft priced above the price threshold where a purchaser and a vendor have entered into a written agreement for the sale of the subject aircraft before 2022 in the course of the vendor’s business of selling subject aircraft equipped for military activities or solely for carrying goods.

A manufacturer, wholesaler, retailer or importer is required to register with the Canada Revenue Agency (CRA) under the Select Luxury Items Tax Act if you are, and in the course of your business activities, you sell or import aircraft priced over $100,000.

Those that qualify are required to apply to register with the CRA as a registered vendor of aircraft by the earlier of:

-

the day of the first sale of an aircraft

-

the day of the first importation of an aircraft

How does the new tax affect aviation finance?

This tax can potentially impact the significant business aviation industry in Canada. According to the International Trade Administration, Canada is still one of the world’s largest for engineering and manufacturing in aerospace. Canada is the number one civil flight simulator producer, third in civil engine production and fourth in civil aircraft production. In addition, about 80% of Canada’s aerospace sector is civil-oriented, and 20% is military oriented.

Because this luxury tax is new, it is hard to determine the exact impact on the Canadian business aviation industry. However, according to a research report by Jacques Roy, professor at HEC Montreal Business School, the luxury tax on aircraft may reduce federal income by 29.9 million a year and lead to at least 2,000 direct jobs lost.

This tax can impact the large Canadian aerospace industry in several ways.

First, sellers will likely pass the 10% tax on to the buyer. Therefore, Canadian buyers may look for solutions to avoid the tax, but beware there may be hefty fines if not compliant.

Lessors may also be impacted if a lessee defaults on an aircraft lease and the lessor is forced to sell the aircraft at a 10% higher price. Sellers who add 10% to an aircraft’s sale price may push the market value for a specific aircraft, which affects the number of potential buyers who would consider that aircraft.

Secondly, Roy’s report estimated a loss of nearly 540 million for aviation companies because potential buyers will begin looking for alternatives, such as basing aircraft in the US or waiting to see if the details of the law’s applications changed.

A report by the Parliamentary Budget Officer (PBO) estimated the government would receive nine million in new revenue from the aviation sector, which accounts for less than ten percent of the new revenue gain (would mostly come from auto sales). The report also estimated that the tax might reduce sales of autos, boats and planes by more than 600 million a year.

In addition, since the tax only applies to aircraft manufactured after 2018, an older aircraft may be more appealing to a buyer, impacting the demand for new aircraft, manufacturers and the labor market. This also counters the government’s efforts to reduce carbon emissions by manufacturing more fuel-efficient planes.

In a letter written by Anthony Norejko, President and CEO of the Canadian Business Aviation Association (CBAA) to Chrystia Freeland, Canada’s Minister of Finance, Norejko said, “the imposition of a luxury tax on aircraft in Canada will have negative consequences for Canada’s aviation and aerospace sectors, affecting job creation, business competitiveness, and importantly, the ability of operators to adopt the cleanest and greenest aircraft, impeding progress related to achieving Canada’s net-zero goals.”

Moving forward

CBAA leaders are encouraging the Canadian government to understand the luxury tax’s full impact on jobs and the economy. They suggest changes in the law, such as increasing the sales price threshold and pausing the luxury tax until the Department of Finance can conduct an economic analysis.

Since the new tax is still in effect, it is important to analyze how it will affect any aircraft transaction. The Canadian Revenue Agency is frequently updating the Luxury Tax specifics, so it is best to consult with a tax professional to determine if you are liable for the new tax and how the purchase of aircraft in Canada will affect your tax obligations.

In addition, each aircraft lender may approach the Luxury Tax differently, so it’s important to speak with your lender when there's a Canadian entity involved to discuss how the additional tax will be handled in the transaction.

Conclusion

Similar to the new Canadian Luxury tax, The United States enacted a 10% federal luxury tax in 1991 but repealed it in 1993. Many see luxury taxes as damaging for luxury goods and believe they do not provide enough revenue to outweigh the damaging effects.

Although we cannot predict the sustainability of the Canadian Luxury Tax, experts agree this will affect the Canadian aviation industry while it is still enforced. To understand how this tax will affect you, the National Aircraft Finance Association (NAFA) recommends speaking with a professional lender and tax professional before engaging in an aircraft transaction in Canada.

For more information about the Select Luxury Items Tax, please see the website: https://laws.justice.gc.ca/eng/acts/S-8.35/.

-

-

NAFA Administrator posted an articleUnderstanding changes to duration for aircraft registries see more

On January 23, 2023, the FAA’s final rule to increase the duration of aircraft registration from three to seven years went into effect. NAFA member, McAfee & Taft aviation attorney Scott McCreary, who also chairs the NBAA’s Regulatory Issues Advisory Committee, was interviewed for an article by the NBAA on what this change means for aircraft owners and operators.

“The direct final rule is an excellent solution by the FAA to address the aircraft registry backlog problem,” said McCreary. “It will reduce the churning of the documents that was required before to renew aircraft registrations on a more frequent basis.”

The FAA is currently in the process of issuing new registration certificates to those impacted by the new rule, beginning with those whose registrations are set to expire first. Owners of aircraft whose registrations were originally set to expire before June 30, 2023, should expect to receive their new registration documents by the end of March 2023.

This article was published in NBAA, January 30, 2023.

-

NAFA Administrator posted an articleSatcom Direct Confirms Three-way Strategic Alliance Enabling Streamlined Tax Reclamation for Busines see more

Melbourne, FL. / 10 January 2022 –Satcom Direct (SD), the business aviation solutions provider, and MySky, the AI-powered spend management platform, today announced the signing of an agreement with tax reclamation experts, VAT IT USA. The three-way strategic integration enables the companies to combine their expertise to deliver streamlined VAT and tax reclamation to mutual customers by leveraging each partner’s technology.

The aggregation of the VAT IT tax recovery option with the MySky financial module, within the digital flight operations platform SD Pro®, acts as a force multiplier for flight departments, operators, and owners. After a complimentary one time sign up to VAT IT, inputted expense and invoice data will be assessed and processed by the tax specialists to initiate the VAT reclamation which saves money, reduces workload, and improves the overall ownership experience. For those requiring Mineral Oil Tax reclamation, the VAT IT module also supports the highly complicated reclamation process to further enhance the offering.

This press release was originally published by Satcom Direct on January 10, 2022.

-

NAFA Administrator posted an articleRyan DeMoor talks with Greg Heine about aviation tax, software solutions, and CAM certification. see more

NAFA member, Ryan DeMoor, Satcom Direct's Aviation Tax & Financial Reporting Manager, talks with Greg Heine of GHC Interactive about aviation tax, aviation software solutions, and CAM certification.

In this episode, we link up with Ryan DeMoor from Satcom Direct. Ryan is an Embry Riddle Grad and also has an MBA in Economics. The first part of his career in aviation consisted of flying CRJs for Independence Air and then Lears and Citations at Northern Jet Management. Ryan then moved into a financial role at Northern Jet Management and spent 6 years at the Amway corporate flight department as a Senior Financial Analyst.

Today, Ryan manages the Aviation Tax and Financial Reporting Solutions business at Satcom Direct and is also a Co-Chair on the NBAA Tax Committee as well as an NBAA CAM (Certified Aviation Manager). In his role at SD, he provides guidance to aircraft owners and operators regarding tax laws, compliance and financial reporting.

This podcast originally aired on GHC Interactive on November 29, 2021.

-

NAFA Administrator posted an articleTax Considerations When Buying a Business Jet see more

NAFA member, Jet Support Services, Inc. (JSSI), shares what you should know about business jet finances beyond operating costs.

During the past 18 months, business aviation has changed greatly. Covid-19 shaped the future landscape, while the 2020 U.S. election also led to new rules and regulations for our industry.

With the much-reported, and welcome influx of first-time business jet buyers since the pandemic, there is much to do to ensure the next generation of jet owners receive the very best tax advice for aircraft ownership and operating costs.

Read full article and view video here.

This article was originally published by JSSI on August 30, 2021.

-

NAFA Administrator posted an articleFinal FET Rule a Big Win for Business Aviation see more

NAFA member Air Law Office, P.A. discusses the latest Federal Excise Tax ruling.

The IRS has issued its final rule regarding the 7.5% Federal Excise Tax (“FET”) on owner flights. The issue arose after the passage of the Tax Cuts and Jobs Act, which left ambiguity on whether FET is due when owners conduct flights on their own aircraft with a management company’s assistance.

The IRS final rule, which adopted many NBAA-suggested provisions that eliminate potentially confusing language in the proposed rule and provide clear standards for taxpayers and the government.

Noncitizen Trusts or Owner Trusts have been in the news a lot lately. Good news for such owners, the final IRS FET rule confirms that owner trust arrangements are covered by the FET exemption.

Also, the rulemaking abandons a proposal to expand the definition of leases disqualified from the FET exemption, which would have severely limited the exemption’s application to many common aircraft-ownership structures.

Additionally, the IRS abandoned a complicated allocation method that would have been required when owners take flights on a substitute aircraft and instead clarified that owners qualify for the FET exemption regardless of whether they conduct flights on their own aircraft under Part 91 or Part 135.

This article was originally published by Air Law Office, P.A. on April 1, 2021.

-

NAFA Administrator posted an articleFlying Free of Federal Excise Taxes see more

NAFA member, David G. Mayer, Partner at Shackelford, Bowen, McKinley & Norton, LLP, discusses Federal Excise Tax regulations.

After years of advocacy by the business aviation industry, the U.S. IRS recently shifted its position on federal excise taxes (FET) largely in favor of aircraft owners.

Since around 2012, the imposition of FET on private aircraft owners has cut across virtually all management services, including related flights conducted under FAR Parts 135 and 91. The IRS position contradicted the core purpose of levying FET on taxable transportation services by air.

In this overly broad interpretation, the IRS tried to impose on the amounts paid by the owner for aircraft management activity and related flights on the owner's aircraft.

FINAL REGS LIFT BURDEN ON AIRCRAFT OWNERS

On Jan. 14, 2021, the IRS issued the final FET regulations. In a pivot away from its previous policies, the IRS provides greater clarity in, and an expansion of the scope of, the exemption under Internal Revenue Code (IRC) Section 4261. In a win by the business aviation industry, the IRS generally realigned the exemption more closely with its purpose of only imposing FET on taxable transportation by air.

However, the IRS also embedded some traps and significant limitations in the final FET regulations that require you—as an aircraft owner, a related party to the owner, or an aircraft manager—to scrutinize these regulations and structure the use of the exemption properly in consultation with your tax advisors and aviation lawyer. Importantly, even if you qualify for the exemption, you must also comply with the FARs lest the FAA demonstrates, at your peril, that safety rules its mission, not the final FET regulations or your desire to use the exemption.

SUMMARY OF FET

FET is a percentage “ad valorem” tax on the amounts paid for transporting property or “persons,” generally, an individual or entity. FET consists of a tax on air transportation, a fuel tax, or a combination of both. The exemption applies to private aviation, which includes flights operated under Parts 135 and 91, but excludes scheduled passenger service for which tickets (or the like) are sold on a seat-by-seat basis to the general public.

FET applies regardless of whether the purpose of your transportation is business or pleasure. The domestic FET is 7.5 percent of the “amount paid” (in cash or property) to transport persons plus a domestic segment fee in the U.S. Also, you may pay facility fees for international trips, which differ from the segment fees on domestic flights based on several factors. Neither fee will be charged when the exemption applies.

To substantiate your qualification for the exemption, you should obtain and keep contemporaneous, “adequate records” of your “aircraft management services,” as well as document the operating and leasing structure explained below.

FIVE KEY FET QUESTIONS AND ANSWERS

The following five questions and high altitude answers should help you navigate the final FET regulations:

What aircraft management services and flights does the exemption cover?

The exemption appears to apply to almost all maintenance and support of, and flights on, your aircraft. The scope includes flight planning, weather forecasting, fueling, insuring, maintaining, and hangaring/storing your aircraft, paying management fees, and performing such other services necessary to support flights operated by an aircraft owner.

Who must pay for management services to qualify for the exemption?

Only an “aircraft owner” qualifies to use the exemption. An “aircraft owner” consists of three narrow classes of interests in aircraft: (1) a holder of legal title to, or holder of “substantial incidents of ownership” in, an aircraft, and (2) a holder of an aircraft lease, namely a lessee, other than a disqualified lease described below.

Although the final FET regulations do not provide a special definition of a “lease,” they explicitly state that an operating agreement with an owner trustee is a lease between the trustee and the “operator” of the aircraft, typically the owner trust beneficiary. The beneficiary can use or lease the aircraft to another person, including a Part 135 management company, the beneficiary, or other person that qualifies to exercise operational control under the FARs.

Otherwise, a lease, which includes a sublease, generally refers to a transfer of the right to possession and use of the aircraft for a term in return for consideration. You might think the IRS should recognize every lease and sublease as a lease under the final FET regulations and classify every lessee and sublessee as “aircraft owner,” but neither is the case.

Instead, the final FET regulations restrict the use of the exemption in at least two significant ways. First, to avoid abuse of the exemption, the IRS excludes any lease between a person, as the lessee, and a management company or related party, as the lessor, with a term of 31 days or less, called a “disqualified lease.” In doing so, the IRS intends to prevent anyone from entering into multiple short-term leases to enable its lessees to use the exemption for daily or occasional flights more akin to chartering an aircraft.

Second, despite advocacy by the business aviation industry, the IRS refused to allow the use of the exemption by “related parties” such as members of an affiliated group, members of an LLC, disregarded entities, and family members just because of their relationship with the aircraft owner. Rather, the related parties must, like any other person, lease the aircraft to qualify as aircraft owners under the final FET regulations though the result seems inconsistent with practical trip planning of the aircraft owners for their related parties.

Can one person pay for management services on behalf of another person?

No person can pay the invoices on behalf of an aircraft owner, other than an agent that pays invoices for the aircraft owner, as the principal. Each aircraft owner must pay the manager directly. Suppose a single-member LLC holds title to the aircraft. A friend cannot pay for the flight of an LLC member even when the member properly leases the aircraft from the LLC in compliance with the final FET regulations.

Will you lose your right to use the exemption if you allow certain others to lease your aircraft?

No. If you lease your aircraft to related parties, you will not lose your qualification to claim the exemption yourself. Each lessee will have to evaluate how to use the exemption, including an analysis of a disqualified lease. Managers must also be aware of their obligation to collect FET to avoid the secondary liability for not collecting the FET from the appropriate person. As a planning point, an aircraft owner may pay for an aircraft flight, but the owner does not have to travel on the flight.

Can you use the exemption on a substitute aircraft?

No. The exemption does not apply to any substitute aircraft you may use. The exemption does not travel with you; you have to travel on your own aircraft. For example, suppose you fly on a third person’s aircraft provided by your management company while your aircraft is being repaired or is otherwise unavailable. In that case, you will be required to pay FET for the flight as a charter.

CONCLUSION

Although the final FET regulations improve the exemption for travel on your own managed aircraft, the IRS may still impose FET if you travel outside the boundaries of the new regulations. And if you fail to comply with the FARs, you may receive a troubling visit from the FAA. Having greater clarity in the final FET regulations is a welcome change, but you may only be able to use the exemption if you plan well ahead of takeoff.

This article was originally published by AINonline on May 14, 2021.

-

NAFA Administrator posted an articleBusiness Aviation Tax - 100% Bonus Depreciation for 2021? see more

NAFA member, Daniel Cheung, CPA, Aviation Tax Consultants, LLC, shares their 2021 Aviation Tax Legislative Update.

2021 Legislative Outlook

Historically, bonus depreciation only applied to factory new aircraft. This changed with tax reforms of 2017. Bonus depreciation was increased to 100% in the year of an aircraft acquisition, and it applies to both new and pre-owned business aircraft. 100% bonus depreciation has been a boon to the general aviation industry in the past few years and it continues to be applicable for 2021 acquisitions.

However, the new administration has promised changes in tax policies. It is expected that both corporate and individual income tax rates will increase for 2021. There is no specific discussion of repealing 100% bonus depreciation currently, but as Congress negotiates and finalizes the tax law changes, bonus depreciation may revert back to 50% and applicable to factory new aircraft only. Tax law changes were not applied retroactively in the past. Therefore, if your business is considering an aircraft acquisition, you should speed up the process to complete the acquisition under the current applicable laws.

By Daniel Cheung, CPA, Aviation Tax Consultants, LLC

Audit Risk for Business Aircraft

“If you write off a business aircraft, that is a huge red flag, and you will be audited by the IRS.”

In conversations with prospects and CPAs from around the country, I continue to hear this sentiment expressed on a regular basis. While “to write-off or not” is the big question, here is my response to those hesitant to take advantage of income tax benefits available from a business aircraft:

Sure, the IRS likes to audit certain tax returns that meet the criteria set forth by the top-secret audit guidelines and algorithm. However, simply depreciating a business aircraft and deducting the associated aircraft operation expenses do not automatically expose the tax return to an audit. If such were the case, I would be defending hundreds and hundreds of IRS examinations annually, as every single client we advise does operate and deduct expenses related to a business aircraft.

Having said that, some reporting scenarios can indeed put a spotlight on generous aircraft depreciation and deductions. My job as a planning advisor is to ensure that my clients do not utilize such ownership structures and reporting scenarios. For example, reporting a sizable tax loss on a Schedule C (sole proprietorship) with only the aircraft deductions and depreciation is known to be “red flag”. On the other hand, aircraft activity and deductions reported within a profitable business income tax return will not draw as much attention from the IRS.

PASSING THE SMELL TEST

A business does need justification to write off an aircraft. A local car dealership or a family practice doctor with only one location or a local clinic will be hard-pressed to prove that a business aircraft can meet the ordinary and necessary standards for business tax deductions. A multi-state car dealership or a medical group operating a business aircraft to travel between multiple locations, however, will easily pass the justification test.

In the current pandemic environment, there is an argument made that a business aircraft is becoming a necessity to safely transport employees due to limited airline services and the inherent health risks with airlines travel.

IF YOU GET AUDITED…

Many factors will influence the outcome of an IRS audit and how the process plays out. A young and eager to impress auditor who has little to no prior aircraft audit experience can lead to a difficult audit with many questions, adjustments and disallowance on the initial examination. Often, the examination will be petitioned to the IRS Appeals Office and a reasonable resolution can be achieved with a more seasoned appeals officer.

The best defense for an IRS audit is also the simplest – to keep good records. We emphasize to our clients the importance of having detailed tax flight logs to support the business use of an aircraft. A well-documented tax flight log will create a positive impression to the auditor who will likely take a less in-depth and less detailed approach to the audit.

TAX FLIGHT LOG

Our motto is “there is no such thing as too much documentation.”

Emails, calendar entries, meeting agendas and other documents and records kept contemporaneously are the most effective supporting documents that should be kept and be available to the IRS auditor. The tax code requires that passengers be classified based on the reason he or she travels on the company aircraft. Classifications include business travel, non-deductible entertainment travel, or deductible personal non-entertainment (PNE) travel.

In closing, a properly crafted business aircraft ownership plan can result in significant income tax savings to the business owner. Detailed documentation can help a taxpayer prevail in case of an IRS examination. Business owners should review their operations and seek professional guidance to determine if business aircraft should be utilized to help manage and grow their business.

This article was originally published by Aviation Tax Consultants and shared by Mente Group on February 25, 2021.

-

NAFA Administrator posted an articleImportant Clarification from the IRS for Owner Flights under Part 135 and its Impact on Aircraft Own see more

NAFA member, Amanda Applegate, Partner at Aerlex Law Group, shares important IRS information for aircraft owners.

For every aircraft purchaser, there is a lot of time and thought that should go into the aircraft ownership and operating structure. Aircraft owners must consider both federal tax regulations and state tax regulations for the state where the aircraft will be based and also states the aircraft will be used frequently. In addition to the tax planning that should occur, there are also significant liability concerns an aircraft owner must take into consideration. Because an aircraft is a flying machine with millions of parts, the liability concerns for an aircraft owner are just as important, if not more so, as the tax planning. This is because when aircraft accidents or incidents occur, the payouts can be considerable and while the amount and type of insurance can reduce the liability concerns, strategic structural considerations can also help. Finally, and equally important to tax and liability considerations, is making sure the aircraft ownership and operating structure is in compliance with the federal aviation regulations (“FARS”), otherwise significant fines can occur or insurance policies can become void.

As described above, aircraft ownership and operating structure has three important factors: tax, liability and regulatory. Just like a three-legged stool where each leg needs to be the same length, in aircraft ownership and operations planning, each factor must be given equal consideration. If one factor is focused on more than the other you could have an aircraft structure that does not work. For example, if the plan is created to provide a maximum amount of liability protection without understanding the constraints of the FARs, then the ownership and operating structure will likely violate the FARs. All three factors must be considered and often the final ownership and operating structure is a compromise between the three factors. At the end of the day the plan may not be the best plan from a tax or liability stand point but it is a plan that has adequate tax planning and liability protection, while still in compliance with the FARs.

The recent pre-publication final rule by the United States Internal Revenue Service (“IRS”) on the Tax Cuts and Jobs Act (TCJA) as it relates to aircraft management companies is helpful to owners because the factors do not require as much of a trade-off any longer. The rule states, among many other things, that when an owner flies on its own aircraft under Part 135, that the 7.5% federal excise tax (“FET”) does not apply. The final rule also clarifies that certain common ownership structure planning tools including owner trusts and qualified leases will also not be subject to FET for owner/lessee flown Part 135 flights when on the aircraft owned/leased. This final rule may change the ownership and operating structure plan for new buyers and for current aircraft owners. The rule also confirms that FET is not due on any management fees paid to a management company for its services.

In the past when an owner elected to fly flights on its own aircraft under Part 91, even when engaging a full-service management company, it did so as part of its ownership and operating structure plan to avoid FET on owner flights. However, it was a trade-off because when an owner flies under Part 91, the owner of the aircraft has operational control and therefore more potential liability. However, now, under the IRS rules, if an owner hires a full-service management company that has a Part 135 certificate, the aircraft owner may elect to have all of its flights flown under Part 135, with the management company in operational control and not have to pay FET. Under the IRS rule, FET is not applicable on owner flights when owner is flying on its own aircraft. The forgoing applies to the aircraft owning entity or another entity that qualifies under the rule, such as a beneficiary under an owner trust or a lessee under a qualified lease.

With the recent pre-publication final rule by the IRS related to the TCJA as it relates to aircraft management companies, new aircraft purchasers may have to make fewer compromises during its aircraft ownership and operating structure planning. Additionally, current aircraft owners may consider restructuring their ownership and operating structure to take into account the new IRS rules related to FET.

This article was originally published by Aerlex Law Group on March 2, 2021.

-

NAFA Administrator posted an article2020 - Was It the Year of the Tortoise or the Hare? see more

NAFA member, Joseph Carfagna, Jr., President, Leading Edge Aviation Solutions, reflects on aircraft transactions and the aviation industry in 2020 and beyond.

I think quite arguably it was both. In order to put things in a bit of perspective, let me paint the picture for you how we experienced it at Leading Edge.

January and February are typically slower months in this industry for aircraft transactions and 2020 was no exception. We all know what then happened in mid-March.

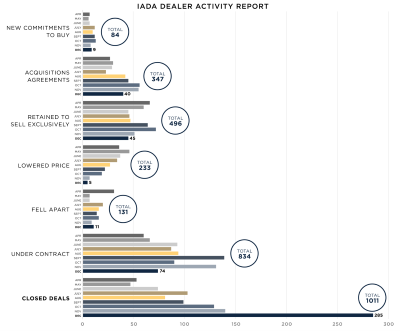

When I was sitting in my home office at the end of March as the new IADA Board Chairman, some of us within IADA decided to create a series of questions to ask the members monthly. This began in April. It was an exercise in taking the pulse of our industry and trying to read if the bottom was going to fall out of it. It was an exercise in survival. It was surreal seeing the data that came in during April and May. Prices were falling rapidly and people were getting sick everywhere here in the northeast, especially where we are located just outside of New York City.We have enjoyed steady success for many years averaging approximately thirty aircraft transactions per year for the last several years. As of June 30th we had closed a grand total of five.

But then things began to turn as the summer started to press on. As my IADA associates reported their sales volume and how many new engagements they had entered to purchase aircraft for clients, I could smell things were beginning to transform. By the time it was the fourth quarter, the market was as hot as I have ever seen it. We finished up with 30 transactions completed and had a year very similar to 2019 – but here is the eyebrow raiser. We transacted as many aircraft in the fourth quarter as we did in the first three quarters combined.

What did this? And will it continue in 2021? Here is what I think contributed to it in order of magnitude:

- Prices dropped quickly to the tune of between 5% for light aircraft and 20% for large aircraft. So non-corporate buyers began swooping in and buying up the attractive deals.

- A new cache of buyers entered the market. These were people who considered purchasing an aircraft and were primarily charter clients or fractional owners. This added to the demand.

- And the icing on the cake, what caused November and December to just go off the charts (literally), was the fear that the favorable tax law that was on the books would disappear. This tax law allowed 100% depreciation in year one for those whose use qualified for it. Many were afraid the rules would change in 2021 if the administration changed. After November 4th, this became a very big driver.

But, What Does the Future Hold?

For 2021, our read at LEAS is as follows:

- Wealthy individuals will still not want to get on the airlines, so there will continue to be some first time buyers that enter this space.

- If the Biden administration begins discussion about repealing the Trump Tax Bill that passed in late 2017, it will put shivers into the market. However, we believe will be short lived. The question is whether the change will be retroactive to January 1, 2021 or will it take effect January 1, 2022. If it’s the former, expect the shivers short term. If it’s the latter, the market will continue to be strong all year. We just will not know until discussions about the tax bill comes to the forefront. When they do, no matter what, the court of public opinion never feels sorry for the private jet owner.

- Once vaccines are widespread mid-year, we believe corporate travelers will begin to fly again in greater numbers.

- Wealthy individuals and privately held companies will begin to need to fly again for business use.

- The airlines will, for the short term, completely underserve this demand.

Put all of this together and we are of the thinking that 2021 will hang in there and be ok because of the real demand that exists for the products and services we offer.

Chart courtesy of the IADA. It shows the activity reported by 45 broker/dealer members from April through December of 2020.

Leading Edge by The Numbers

With 895 transactions completed since 1989, here is a look at our 2020:

13 Gulfstream, 5 Citations, 4 Challengers, 2 Turbo Props,

2 Falcons, 1 Global, 1 Falcon, 1 Nextant and 1 Phenom 100.

Thank you to all of our clients and associates that helped LEAS have a successful 2020. It started as the year of the tortoise but sure finished as the year of the hare.This article was originally published by Leading Edge Aviation Solutions on February 2, 2021.