Activity

-

Tracey Cheek posted an articleNAFA member, Brant Dahlfors, with Jet Transactions, shares the 2018 Q3 Bombardier Market Update. see more

NAFA member, Brant Dahlfors, with Jet Transactions, shares the 2018 Q3 Bombardier Market Update.

2018 continues to grow and show strong signs of stability. Q3 was exciting for new product certifications led by Gulfstream announcing the certification of the all new G500 and followed by Bombardier's certification of the Ultra-Long Range Global 7500. On top of new large aircraft product announcements at EBACE in May, confidence in future growth is apparent.

Overall, in the segments we track, Q3 reflected the normal seasonal variations (vacation time) and new deliveries and pre-owned transactions were down 20+% over Q2. Shops are full with pre- buys and NextGen upgrades in addition to their normal maintenance customers. The pre-owned inventory continues to fall, down another 8.1% this quarter. In many cases, popular late model aircraft are below 5% of the fleet being available for sale. Gross numbers of pre-owned transactions will continue to decline for the foreseeable future as the market is seriously supply constrained.

How does this affect the Bombardier pre-owned market? With a whirlwind of new options coming to market soon, factory new buyers should soon start the migration from the existing product line to the latest and greatest offerings. Bombardier is well positioned with three new models to discuss – all available for delivery in the next 1-2 years. Overall pre-owned transaction levels dropped significantly across the Bombardier tracked models, with a slight uptick in inventory for sale. New deliveries also edged downward, the largest drop across all three OEM’s, though not uncommon traditionally for the third quarter.

Read the full report here.

The original market update was published by Jet Transactions on October 15, 2018.

-

Tracey Cheek posted an articleDassault Market Update Q3 • 2018 see more

NAFA members, Mark Bloomer and Brant Dahlfors, with Jet Transactions, share the 2018 Q3 Dassault Market Update.

2018 continues to grow and show strong signs of stability. Q3 was exciting for new product certifications led by Gulfstream announcing the certification of the all new G500 and followed by Bombardier's certification of the Ultra-Long Range Global 7500. On top of new large aircraft product announcements at EBACE in May, confidence in future growth is apparent.

Overall, in the segments we track, Q3 reflected the normal seasonal variations (vacation time) and new deliveries and pre-owned transactions were down 20+% over Q2. Shops are full with pre-buys and NextGen upgrades in addition to their normal maintenance customers. The pre- owned inventory continues to fall, down another 8.1% this quarter. In many cases, popular late model aircraft are below 5% of the fleet being available for sale. Gross numbers of pre-owned transactions will continue to decline for the foreseeable future as the market is seriously supply constrained.

How does this affect the Dassault pre-owned market? Pre-owned inventory levels as well as the number of pre-owned Falcon products changing hands edged lower, with Average Ask Prices falling significantly lower on 3 out of eight tracked models. New aircraft deliveries remained low in Q3 down to only 3 new aircraft. Dassault has always been a niche provider, but it's time to pick up the pace a bit here. On the pre-owned side, several models faired quite well, with late model and NextGen equipped units leading the charge on transactions and holding their value well in the pre-owned market.

Read the full report here.

The original market update was published by Jet Transactions on October 15, 2018.

-

Tracey Cheek posted an articleAINsight: Piercing the Aircraft LLC Veil see more

NAFA member, David Mayer, of Shackelford, Bowen, McKinley & Norton, LLP, discusses the recent Texas Supreme Court ruling regarding special purpose LLCs.

Aircraft owners who form limited liability companies (LLCs) typically believe that this structure will shield them from personal liability. However, that reasonable expectation could be incorrect given a recent Texas Supreme Court decision in Texas v. Morello (Morello).

In Morello, the sole member of an LLC found that his LLC did not protect him from personal liability for his and its violations of the Texas Water Code. While unrelated to aviation, this ruling also could affect members and others standing behind LLCs that own aircraft. Morello could hand the FAA, as well as other state and federal governmental agencies, a powerful tool to levy fines and penalties on LLCs, their pilots, members, and other officials for violations of the Federal Aviation Regulations (FARs).

This point is illustrated by referring to one of the most common violations of the FARs: illegal operations of an aircraft in an LLC that is a “flight department company,” meaning a company formed solely to own and operate an aircraft without any other business function. Perhaps of greater concern, people who make claims for personal injury, death, or property damage related to aircraft might consider how to leverage Morello as part of a litigation strategy in which they make high-dollar liability claims against members, managers, pilots, and others behind the LLC.

As background, LLCs statutes exist in all U.S. states. An LLC affords its members and managers a “shield” against personal liability for the LLC's debts, obligations, and liabilities. Each state statute differs in some ways, but all of them make LLC members personally liable for their wrongful actions under a principle referred to as “piercing the corporate veil” (or here, the “LLC shield”). Certain LLC statutes create significantly fewer barriers to piercing the LLC liability shield, such as those in Maryland, Massachusetts, and California. Ironically, Texas adopted an LLC law that strongly shields members.

Two long-existing methods to pierce the LLC shield highlight ways to incur personal liability. First, members or managers might be held individually liable for their “tortious” conduct (a legal term that means a “wrong” committed by the individual). Torts include defrauding an aircraft buyer, even if the conduct was undertaken or condoned by the member while acting individually or in his or her official capacity as an agent for the LLC.

Second, a court can pierce the LLC shield and impose personal liability on a member when he or she treats the LLC as the member’s “alter ego.” An alter-ego structure can sometimes be identified when the single member figuratively puts the LLC “on the shelf,” ignoring LLC formalities and, among other elements, commingles his/her money with LLC funds—as if the LLC did not exist. Fortunately, few courts impose personal liability on members just for failing to follow the formalities.

But the Morello case seems to provide a third and apparently new way to hold an LLC’s members and others personally liable. Although plaintiff Morello conducted all business of the LLC, he argued that the robust LLCshield under the Texas statute protected him from personal liability for the regulatory violations by his LLC.

The court rejected Morello’s arguments and found him personally liable for civil penalties levied by the Texas environmental agency, even though he acted in his official capacity as an agent (employee) of his LLC. In a technical interpretation of the Water Code, the court refused to let Morello hide behind his LLC when the violated statute contemplated that a “person” could be held directly liable for the violation.

In the context of the highly regulated private aviation industry, it is a short step for the FAA to apply the court’s approach to violations of the FARs, at least in Texas, especially where a “person” in the FARs generally includes individuals and LLCs in an analogous manner to Morello.

To illustrate, consider the following common flight department company scenario. An individual (member) creates a single-purpose LLC—let’s call it Owner LLC—to own and operate a business aircraft. The member exclusively manages and owns Owner LLC and bypasses all LLC formalities. He personally makes all decisions about the aircraft, pilots, operations, and maintenance. He transfers cash into the LLC to pay costs of ownership and operation of the Owner LLC aircraft.

In this situation, taking a page out of Morello’s playbook, the FAA could pierce the LLC shield and levy civil fines/penalties on both the LLC and its member for operating a flight department company in violation of the FARs. The violations consist, in part, of the LLC failing to hold an appropriate air carrier certificate and for unlawfully “compensating” the LLC for illegal charter/commercial flights.

In these actions, the member risks personal liability under Morello whether he or she acts individually or in an official capacity for the LLC. Further, the wrongful acts of the true owner/member, who treats the LLC as an alter ego, could also increase the potential exposure of the member. The violations might encourage others, if the facts seem right, to seek damages for personal injury or property damage based in part on the FAR violations.

An LLC owner might suggest that the remedy for these risks is buying liability insurance. However, it is rare that insurance covers fines or civil penalties, and a serious violation of the FARs could even cause an insurance company to disclaim coverage or reserve its rights not to pay for liability or property damage claims. In short, LLCmembers, managers, and pilots should have no illusions that, under Morello, they could potentially face personal, uninsured liability for violations of the FARs, without even considering pre-existing personal liability theories.

LLC members typically don’t worry about personal liability if an LLC owns their private aircraft. And they need not be overly concerned about Morello or the FAA relating to the LLC personal liability exposure if, in general, they do not treat their LLCs as alter egos, avoid tortious behavior, and comply with the FARs, including structuring LLCfunctions properly to avoid flight department company status.

But a regulatory compliance audit now might save an LLC owner from stinging FAA civil fines/penalties for operating a flight department company or violating other FARs, not to mention exposure to liability claims for personal injury or property damage. It should not be too hard to get the compliance right, but getting it wrong or ignoring compliance could take LLC members into an expensive and avoidable morass.

Note: The LLC issues covered in this blog do not constitute, and should not be relied on or construed as, legal advice of any kind. Most cases and LLC structures require extensive legal analysis. Each person should consult knowledgeable counsel in all matters covered by, or related to, this blog.

David G. Mayer is a partner in the global Aviation Practice Group at Shackelford, Bowen, McKinley & Norton, LLP in Dallas, which handles worldwide private aircraft matters, including regulatory compliance, tax planning, purchases, sales, leasing and financing, risk management, insurance, aircraft operations, hangar leasing and aircraft renovations. Mayer frequently represents high-wealth individuals and other aircraft owners, flight departments, lessees, borrowers, operators, sellers, purchasers, and managers, as well as lessors and lenders. He can be contacted at dmayer@shackelfordlaw.net, via LinkedIn or by telephone at (214) 780-1306.

The original article was posted to AINsight Blog on September 14, 2018.

-

Tracey Cheek posted an articleFuture of the Offshore Heavy Market see more

NAFA member, Jason Kmiecik, acting president of HeliValues, Inc., writes about the shift in the offshore heavy market.

Oil prices are slowly on the rise, but supply still remains higher than demand and values continue to decline. The face of the offshore heavy market has begun to shift.

While there are many heavy class models in various roles, the predominantly offshore AS332L2, EC225LP/H225, and the S-92A have generated the most questions about the current state and future of the heavy class of helicopters. These aircraft have been impacted by multiple factors; a transition in the market from new purchase or resale to one largely influenced by the leasing sector, over purchasing of these aircraft by the lessors and operators during the boom of oil and gas, the slump in oil prices that has significantly decreased demand, and of course, the plight of the EC225 after its grounding and subsequent rejection by union oil workers.

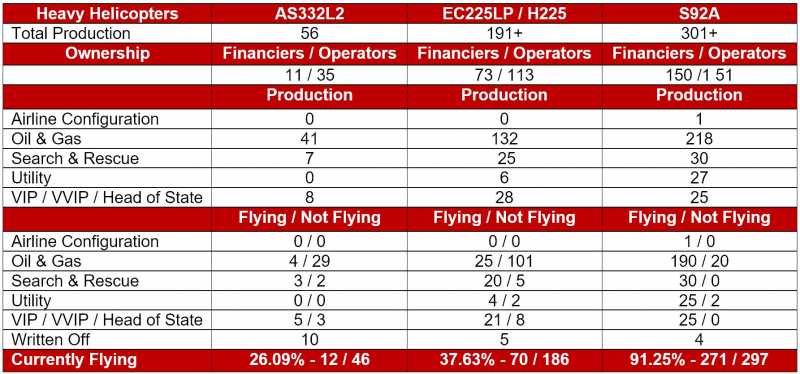

Although the S92A has fulfilled many of the obligations created by the absence of the AS332L2 and EC225, there continues to be an excess of S92As which remain idle or in storage due to a lack of contracts. The chart below illustrates that there are 172 of these aircraft currently in abeyance. This number of aircraft would not be easily absorbed in today’s market or even in the long term.

Current Estimated Operational Breakdown

As a result of this oversupply, there has been a transition of these machines from their primary market into secondary markets. There has been some restored optimism for the EC225LP. The aircraft is finding renewed interest in the utility, para-public (search & rescue, law enforcement, firefighting), and military markets. Utility operators that hadn’t previously entertained using EC225 for their operations are now considering adding these aircraft to their fleet. It has been purported by some in the industry that activity for the EC225 will continue to increase as witnessed over the past six months. This is made evident by recent transactions and conjecture that there are several others pending. Additionally, there has been interest in converting the offshore S92A into a Search & Rescue role. Lessors have been acting on these interests and forming plans for placement of their aircraft. However, both aircraft are suffering from a shortage of parts to perform the necessary modifications. The unavailability of parts has resulted in extensive lead time for conversions to be completed.

Introduction of the Super Medium

The introduction of the 7/8-ton super medium class of helicopters poses a challenge to all heavy class helicopters. The super medium class of helicopters includes the Airbus EC175, Leonardo AW189, and the anticipated Bell 525 helicopter. These aircraft are capable of seating 16 to 18 passengers and perform the same work roles as those in the heavy class. It has been indicated by some that the super medium class of helicopters is capable of performing 90% to 95% of the offshore missions currently flown by heavy class helicopters.

Lessors have a large investment into the heavy class of helicopters, particularly the S92A. Based on current supply and lease rates, it can be more economical to lease an S92A over purchasing a new super medium. It is likely that leasing companies will offer and promote the heavies over the super mediums as the lower cost alternative. Ultimately, the demand of the operators and oil companies dictate the market. If operators/oil companies choose super mediums over the S92A, leasing companies would try to meet that demand and there would be an increase in the number of S92As on the resale market further impacting values. However, the S92A cannot be completely replaced by super medium class aircraft. The S92A would still have a significant market share of the offshore and search and rescue sectors.

Fleet Diversity

Some operators and oil companies have started to ask themselves if they may be too heavily dependent on a single model. Should a massive, long-term grounding like the EC225LP effect the S92A, the shortage would be devastating to operations. Diversifying a fleet with a mix of super mediums and S92As could lower some of the risks should such an event occur. The idea of diversifying a fleet is further spurred by sustained low oil prices which have caused long-range exploration to drastically decrease. Aircraft with a longer range will be in less demand until there is an increased need for long-range exploration.

Impact of Leasing

The helicopter industry has experienced a boom in leasing activity similar to the commercial airline industry, only over a much shorter period of time. Before the entry of the only dedicated helicopter lessor, Milestone in 2010, leasing activity was mostly between operators and on a much smaller scale. Presently, there are six major helicopter lessors with combined fleets of 600+ helicopters worth an estimated seven billion dollars, a large percentage of which are comprised of heavy class helicopters. Since a majority of heavy class helicopters are now owned by leasing companies, this means the lessors are essentially controlling the market for these assets. As lease rates drop to move idle inventory, leasing becomes an even more favorable option over buying a helicopter in today’s market. However, if lease rates continue to fall, asking prices and resale values will continue to decline and may not recover for many models.

Exact numbers of heavies currently for sale is difficult to determine. Based on publicly advertised listings, there are only four AS332L2s, fifteen EC225LP/H225s, and nine S92As. Many have chosen to place their aircraft with brokers as off-market listings, which means these numbers are conservative. Additionally, it is expected, over the next 12 to 16 months, an estimated 40-45 S92As will be coming to the end of their lease term. It is uncertain how many of those leases will be renewed. In response to the continued decline in the offshore heavy market, lessors have expanded their business to include light turbines. Lessor will likely put more focus in markets that are showing more stability and growth such as EMS, law enforcement, utility, and firefighting.

Today operating leases remain an attractive alternative to traditional financing for operators looking to retain cash, maintain balance-sheet flexibility, and align lease terms with contract terms. These benefits are all the more important under the current market conditions.

Outlook

The heavy offshore market continues to face many challenges, but the helicopter industry as a whole is resilient. It’s not certain how this market will evolve, but with time, it will adjust. What number of these offshore heavy aircraft find opportunities in different work roles, and what impact the new class of super mediums will have, will determine how that future is defined.

This article was originally published by HeliValues, Inc. on February 2, 2018.